宏观经济学笔记

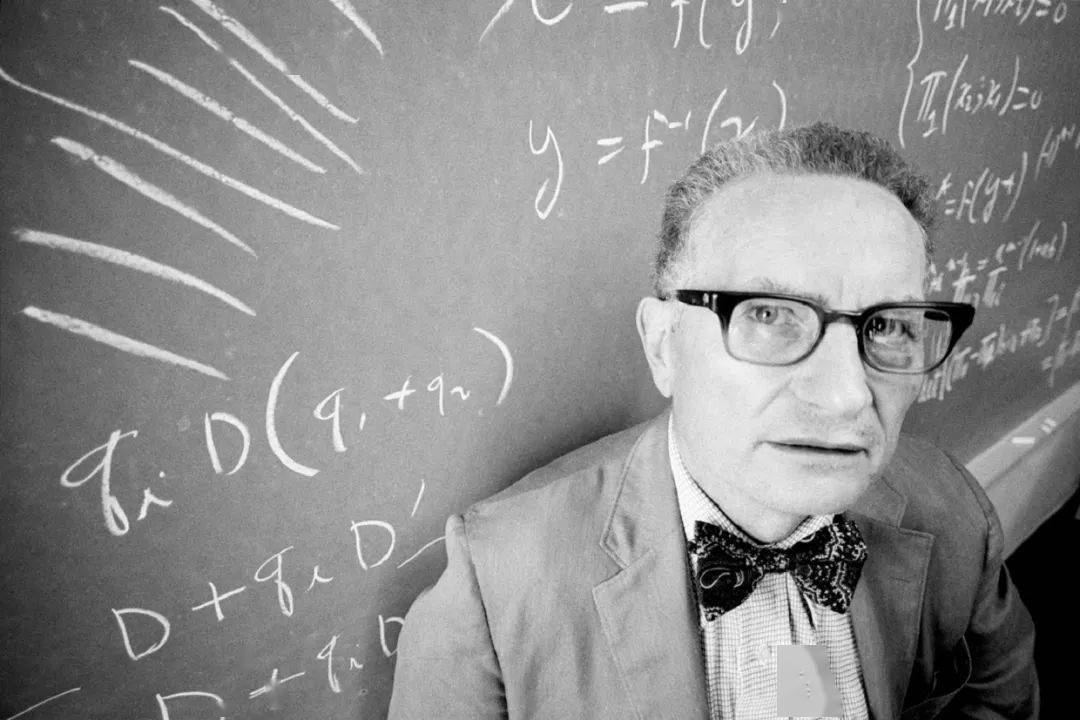

本笔记基于萨缪尔森《宏观经济学》(第19版),参考了本学期上课使用的PPT。

目录位于本页面的右侧,可通过点击目录中的标题实现笔记内快速跳转。

一般而言,若您未使用私密模式浏览,本页面将自动记录您的浏览位置。

在右下角的设置模块中,您可以调整字体大小,以适应不同的屏幕尺寸。

为适应ISBF的英语期末考试与英语教材,本笔记正文语言主要使用英语。

若需查阅萨缪尔森《宏观经济学》(第19版)中文版,请点击本行链接。

请注意,由于不可抗力因素,以上链接暂时失效。

Update Log

04/19 Added notes for Chapter 5

04/17 Fixed an error in the display of formulas within the webpage and added notes for Chapter 4.

Chapter 1: Overview of Macroeconomics

Macroeconomics is the study of the behavior of the economy as a whole. It examines the overall level of a nation’s output, employment and prices.

The Birth of Macroeconomics

Classical Economics Dates back to the late 1700s, Rooted in the laissez faire writings of Adam Smith, David Ricardo, and Jean Baptiste Say.

Keynesian Economics emerged after the Great Depression.

Monatarism(货币主义) emerged after the stagflation(滞涨).

Macro Problem

#1:The Rate of Economic Growth measured by growth in the Gross Domestic Product or “GDP” defined as the market value of all the final goods and services produced in a country in a given year.

This gives rise to the concept of economic cycles. The business cycle is the short-run alternation between economic downturns and economic upturns, which is divided into three parts: Depression, Recessions and Expansions(or Recoveries).

#2:Unemployment Rate, which is measured as the number of unemployed persons divided by the number of people in the labor force.

#3:Inflation, which is Defined as an upward movement of prices from one year to the next and measured by the percentage change in price indices such as the CPI(Consumer Price Index), the Producer Price Index, or the so-called GDP deflator.

Macro Policy

Goals: A high and growing level of national output, High employment with low unemployment and A stable or gently rising price level

Tools: Fiscal Policy(government expenditures or tax) and Monetary Policy(change the money supply, Buy and sell bonds, regulate financial institutions to influence interest rates, stock prices, housing prices etc. It can also affect housing investment, commercial investment, net export etc.)

Aggregate Supply and Aggregate Demand

Aggregate Supply refers to the total quantity of goods and services that the business willingly produce and sell in a given period.

Aggregate Demand refers to the total amount that different sectors in the economy willingly spend in a given period

To better discuss the AS-AD framework, we introduce two concepts: Exogenous Variables(外生变量)&Induced Variables(引致变量)

(AS) = Employee compensation + rents + interest + profit, upward because higher price levels create an incentive for businesses to produce and sell additional output while lower price levels reduce output.

(AD) = Consumption + Investment, slopping because of Wealth Effect, Interest Rate Effect and Foreign Exchange Rate Effect

Macroeconomic Equilibrium is the equilibrium values of price and quantity that satisfy the buyers and sellers all taken together

Summary of AS-AD:

WARNING: DD-SS with such things as national income and other goods held as given, AD-AS with such things as the money supply, fiscal policy and the capital stock held constant.

Chapter 2: Measuring Macroeconomics Activity

Recommended Economic Databases

Cilck hereFlow of Macro Activity

Measures of GDP

$Y=C+S=C+I+G+{NX}$

#1:as spending on domestically produced final goods and services

#2:as the value of production of final goods and services

#3:as factor income earned from firms in the economy

Theoretically, these three measures are equal.

Flow-of-Product: Add together all the consumption dollars spent on these final goods, and you will calculatethis simplified GDP, $\text{GDP}=\sum_{i=1}^n{\text{C}_i\text{Q}_i}$

Earnings or Cost Approach: GDP is as the total of factor earnings (wages, interest, rents, and profits) that are the costs of producing society’s final product.

Value-Added Approach: which is designed to avoid Double-counting Problem. It is the difference between a firm’s sales and its purchases of materials and services from other firms.

Tips: GDP Excludes intermediate goods that used up to produce other goods

Types of GDP

Actual GDP represents what we are producing.

Potential GDP represents the maximum amount the economy can produce without causing inflation.

We can judge whether the economy is thriving(景气) by comparing these two indicators.

Real GDP is the value of final goods and services produced in a given year when valued at the prices of a reference base year.

Nominal GDP is the value of goods and services produced during a given year valued at the prices that prevailed in that same year.

Real GDP(实际GDP) is nominal GDP(名义GDP) adjusted for inflation.

GDP deflator(GDP平减指数)=${\frac{\text{Nornimal GDP}}{\text{Real GDP}}}$

GNP(Gross National Product) is widely used until recently, is the total output produced with labor or capital owned by China residents

NDP(National Domestic Product) equals to the total final output produced within a nation during a year, where output includes net investment, or gross investment less depreciation(折旧).

NDP = GDP- depreciation

Savings-Investment Identity

Cunsumption The value of all goods and services bought by households

Investment consists of the additions to the nation’s capital stock of buildings, equipment, software, and inventories during a year, including business fixed investment, residential fixed investment and inventory investment. Generally speaking, we recognized STOCK as Investment.

Nation Income represents the total income received by labor, capital, and land. It is constructed by subtracting depreciation from GDP

NI = Wage + Profit + Interest + Rent

DI(Disposable Income) tells you how many dollars per year households actually are available to spend, you can calculate the market and transfer income received by households and subtract personal taxes

Price Indexes

CPI(consumer price index) is a measure of the overall cost of the goods and services bought by a typical consumer. It compares the price of a fixed basket of goods and services to the price of the basket in the base year

GDP deflator reflects the prices of all goods and services produced domestically compares the price of currently produced goods and services to the price of the same goods and services in the base year

PPI(producer price index) measures the level of prices at the wholesale or producer stage.

GDP is the best single measure of the economic well-being of society, it is not a perfect measure of happiness or quality of life, however. For example, GDP cannot measures the value of leisure.

Chapter 3: Consuming and Investment

Consumption and Saving

Disposable income is the amount of money you have left after paying taxes to the government.

Autonomous Consumption is the level of consumption that occurs regardless of changes in one’s income.

Induced Consumption(${MPC}*{Y_d}$) is a level of “induced consumption” that will depend on the individual’s disposable income.

Consumption Function(${C_0}$) shows the relationship between the level of consumption expenditures and the level of disposable personal income.

APC(average propensity to consume)shows the proportion of consumption to incomes.

MPC(marginal propensity to consume) shows the response of consumption to changes incomes.

Keynesian consumption function simply as follows:$C={C_0} + {MPC}*{Y_d}$

The Saving Function shows the relationship between the level of saving and income.

MPS(marginal propensity) is defined as the fraction of an extra dollar of disposable income that goes to extra saving.

The consumption theory of Relative Income Hypothesis(相对收入假说) was put forward by Duesenberry. Consumption depends not only on absolute income, but also on relative income, that is, past income and consumption habits. Demonstration effect(示范效应) and Ratcheting effect(棘轮效应,消费水平难以向下调整)

Permanent-income theory(永久收入理论)is the trend level of income that is, income after removing temporary or transient influence due to the weather or windfall gains or losses. According to the permanent-income theory, consumption responds primarily to permanent income, do NOT respond equally to all income shocks.

Modigliani assumes that people save in order to smooth their consumption over their lifetime.

Three Stages Analysis:

0~T1:Childhood, c>y, s<0, net debit

T1~T2:young, c

T3~∞:old, c>y, s<0, s is for consumption

Shifts of the Aggregate Consumption Function:

Expected Future Disposable Income, Aggregate Wealth or Other Influences

The Declining Personal Saving Rate:

Social security system, Capital markets, The rapid growth in wealth or Other Influences

Investment

Investment expenditures include:

#1:purchases of residential structures,

#2:investment in business plant and equipment,

#3:additions to a company’s inventory.

Determinants of Investment:Revenues, Overall level of output, Interest Rate, Expectation

Chapter 4: Business Fluctuations and the Theory of Aggregate Demand

八次危机:中国的经济周期

温铁军《八次危机》:中国历次经济危机启示录Business Cycles

Closely related to the issue of economic growth and real GDP as a measure of such growth is the problem of “business cycles.” The term business cycle refers to the recurrent ups and downs in real GDP over several years.

The business cycle is the short-run alternation between economic downturns and economic upturns. Depression is a very deep and prolonged downturn. Recessions are periods of economic downturns when output and employment are falling. Expansions, sometimes called recoveries, are periods of economic upturns when output and employment are rising. Peaks and Troughs mark the turning points of the cycle.

There are many theories designed to explain the business cycle. Roughly, they can be divided into two parts: Exogenous vs. Internal.

#1:Monetary Theories(货币商业周期理论) - Milton Friedman

The expansion and contraction of money and credit are the most basic factors affecting total demand and the decisive force leading to the business cycle.

#2:Multiplier-accelerator Model(乘数加速数模型)

The Multiplier: Exogenous demand shock(I↑)→AD shifts→Y↑, Multiplier effect:∆Y>∆I

The accelerator: Y↑→new investment→I↑, Accelerator effect: ∆I>∆Y

When two effects interacts the economy booms until it reaches its ceiling due to the restriction of some recourses, then the economy cools down and business cycles happen endogenously.

#3:Political theories of business cycles(政治商业周期理论)

- Nordhaus (1975): opportunistic political business cycle(投机性政治商业周期理论)

The economic cycle of expansion before the election and contraction after the election has been formed.

- Hibbs(1977): partisan political business cycle(党派政治商业周期理论)

When political parties representing different ideologies alternate in power, the economic situation will fluctuate with the change of election results

#4:Equilibrium-business-cycle(均衡商业周期理论) - Robert E. Lucas Jr.

Market participants only have partial market price information, resulting in price expectation errors.

#5:Real-business-cycle(真实商业周期理论) - Edward Prescott & F.E.Kydland

Source of economic fluctuation is real factors as change in natural recourses.

#6:Theory of innovation(创新商业周期理论) - Joseph Alois Schumpeter

Interpret the words literally.

AD Curve

As the price level falls, the purchasing power of consumers increases, and they demand more goods and services. The real value of money is measured by how many goods and services each dollar will buy. A lower price level increases the real value or purchasing power of accumulated financial assets such as savings accounts and bonds that have fixed money values.

Chapter 5: The Multiplier Model

Some Functions

The Savings-Investment Identity

In a closed economy:

In a open economy:

Keynesian Model, or Multiplier Model

It is a theory which provides a straightforward approach to using fiscal policy to close a recessionary gap. The model may be used to calculate very precisely how much government spending must be increased, or taxes must be cut, to stimulate an economy back to full employment.

There is a MOST IMPORTANT ASSUMPTION which is FIXED PRICES.At the same time, it’s known that $\text{AE(Aggregate Expenditures)=C+I+G+X}$

Keynesian Cross: Output equals to Expenditure when the curve of AE cross the 45° Line

In this way, we can divide the applied policy into 2 types:

#1:Expansionary Fiscal Policy: To close a recessionary gap

#2:Contractionary Fiscal Policy: To cool down an overheated economy

To explain the mechanism of multiplier, we introduce two relative concepts here:

#1:Injection(注入): An addition of income to the circular flow

#2:Leakage(漏出): Opposite of the Injection

Government and international trade are two important ways to determine actual output.

Keynesian Multiplier: the number by which a change in AE must be multiplied in order to determine the resulting change in total output. It is determined by MPC.

THe model ignores the impact of money and credit.

The simplest model ignore foreign impacts.

AS is left out the story.

Chapter 6: Money and Commercial Banking

Money and Money Demand

Basic Def: Anything that can be widely used and accepted in exchange for other goods and services.

Components:Currency (paper bills and coins) and Demand Deposits(活期存款)(balances in bank accounts)

Functions:Medium of Exchange, Unit of Account, Store of Value

To explain the differences among those concepts, we ask GPT for a more understandable answer:

M1:M1是指一国货币供应量中最流通的部分,也被称为狭义货币。M1包括所有流通中的现金,以及银行存款账户中的可转让存款(如支票账户和借记卡账户)。因此,M1是指一国最直接可用于购买商品和服务的货币数量。

M2:M2是指一国货币供应量中的广义货币部分,它包括M1,以及其他一些流动性较高的资产。除了M1的现金和可转让存款外,M2还包括所有的储蓄存款、定期存款和其他的较为稳定的货币市场基金等。M2被认为是一种更全面、更广泛的货币供应量衡量标准。

L:L是一国的流通货币和存款中除去中央银行存款和政府部门存款的部分,也被称为广义信用。L包括一国的私人部门储蓄、企业债券和其他金融资产。L通常被用来评估整个经济体的债务水平和信用风险。

Interest Rate

Technically, the interest rate is the amount of interest paid per unit of time, expressed as a percentage of the amount borrowed.

Interest is the payment made for the use of money, and it is often called the price of money.

Liquidity

An asset is said to be liquid if it can be converted into cash quickly with little loss of value.

Illiquid assets or loans usually command higher interest rates.

Demand

The major determinants of money demand are known as the transactions demand and the asset demand.

#1 Transactions Demand is the result of the different time of expenditure and income. The demand of money will change with Price, Income, Interest Rate and nominal GDP.

#2 Asset Demand is concerning the store of value and speculative motive(投机动机)

Banks and the Money Supply

Reserves are deposits that banks have received but have not loaned out.

In a fractional-reserve banking(部分准备金银行) system, banks hold a fraction of the money deposited as reserves and lend out the rest.

When a bank makes a loan from its reserves, the money supply increases.The money supply is affected by the amount deposited in banks and the amount that banks loan.

Deposits into a bank are recorded as both assets(资产) and liabilities(负债).

Loans become an asset to the bank.

The money multiplier is the reciprocal of the reserve ratio:

R=Reserve Ratio

Modern Financial System

Finance: the process by which economic agents borrow from and lend to other agents in order to consume or invest.

Financial System: encompasses the markets, firms and other institutions which carry out the financial decisions of households, business, governments, at home and aboard.

Important Financial Markets: Stock, Bond(债券), Foreign Exchange Markets

Financial Intermediaries(金融中介机构): Institutions which provide financial services and products.

银行主导型金融体系: 银行等金融中介在信息搜集和处理方面具有优势,银行能够实施更加有效地资金监管;银行等金融中介对企业的影响力较大,对企业发展会带来负面效应;银行具有天生的谨慎倾向性,使得具有银行主导型金融结构的金融体系不利于企业创新和增长

市场主导型金融体系: 金融市场能够比银行发挥更加有效的创新推动作用;金融市场允许投资者持有不同的信息和看法,银行更善于获取和处理标准化信息,在为技术和产品较新的高风险项目融资时,通常缺乏效率;在资金监管的效率上,金融市场相比银行存在较不足。过于分散的股权结构容易导致监管中的搭便车问题,但股权的过度集中又会给大股东提供攫取企业资源的机会,导致中小股东的权益遭到侵害

Functions: Transfers Resources, Manage Risks, Pools and Subdivides(再分配) Funds, Clearinghouse(信息交换) Function

Menu of Financial Assets:

Ø Money

Ø Savings accounts

Ø Credit market instruments

Ø Common stocks

Ø Money market funds and mutual funds

Ø Pension funs

Ø Financial derivatives(金融衍生产品)

The Stock Market

A stock market is a place where shares in publicly owned companies - the titles to business firms - are bought and sold.

The rate of return is the total gain from a security(证券) (measured as a percent of the price at the beginning of the period).

Risk refers to the variability of the returns on an investment.

!()[Chp6-Pic8.png]

Efficient-market Theory: YOU CAN’T OUTGUESS THE MARKET

Ramdom Walk: Price is completely unpredictable

Chapter 7: Central Banking & Monetary Policy

The Federal Reserve

Structure: The Board of Governors; The Regional Federal Reserve Banks; The Federal Open Market Committee

Versue the system of PBC: 9分行+2营业管理部+25支行

Monetary Toolbox

#1: Open-market Operations

(公开市场操作,央行与指定交易商进行有价证券和外汇交易)

#2: Changing the reserve requirement

R down→M down→i Up→I, C, X down→AD down→Real GDP and Inflation down

#3: Changing the discount rate

贴现率,将未来支付改变为现值所使用的利率。商业银行需要调节流动性时,要向央行付出与贴现率相应的成本

In the open economy, we should recognize that Reserve Flows, The Role of Exchange-Rate System and Foreign Risk are three main aspects of the monetary policy.

货币政策传导机制

Stagflation(滞涨) is a combination of slow growth and rising prices.

我知道 你相信你明白了你认为我所说的, 但是我不能肯定你是不是意识到了你所听到的并不是我的意思。——格林斯潘

Chapter 8: The Process of Economic Growth

Key of long-run growth: Rising Labor Productivity

Three Misconceptions about Getting Rich: Depend on Diligence, Depend on land, Depend on Natural Resources. Actually, the data shwos that the per capita GDP typically exhibits a negative correlation with the above-mentioned three points.

Economic Growth

Economic growth represents the expansion of a country’s potential GDP or national output.

A closely related concept is the growth rate of output per person

This determines the rate at which the country’s standard of living is rising.

Accumulating capital requires a sacrifice of current consumption over many years.

China’s capital accumulation is carried out by rural areas, with the price difference between industrial and rural products as the carrier. Its main form is to control the purchase and sale of agricultural products including grain.

In the most rapidly growing countries, 10 to 20 percent of output may go into capital formation.

Four wheels of economic growth

#1 Human Resources: Labor supply, education, discipline(训练), motivation

However, many economists believe that the quality of labor inputs —the skills, knowledge, and discipline of the labor force—is the single most important element in economic growth.

#2 Natural Resources: Land, minerals, fuels, environmental quality

Some high income countries like Canada and Norway have grown primarily on the basis of their ample resource base, with large output in agriculture, fisheries, and forestry.

#3 Capital Formation: Machines, Factories, Roads

Roads, power lines, ports, information networks, and other underpinnings for economic activity are known as infrastructure.

#4 Technology: Science, Engineering, Management, Entrepreneurship

Technological advance has been a vital fourth ingredient in the rapid growth of living standards.Technological change denotes changes in production processes or the introduction of new products or services.

Theories of Growth

#1:The Wealth of Nations - Adam Smith

Because land is freely available, people simply spread out onto more acres as the population increases.

Because there is no capital, national output exactly doubles as the population doubles.

Wages earn the entire national income because there is no subtraction for land rent or interest on capital.

Output expands with the population, so the real wage per worker stays constant.

However, this cannot continue:

Population still grows, and so does the national product.

But output must grow more slowly than does population.

Why? The law of diminishing returns.

#2:Reverend Thomas Malthus

Population pressures would drive the economy to a point where workers were at the minimum level of subsistence.

Whenever wages were above the subsistence level, population would expand.

Below subsistence wages would lead to high mortality and population decline.

#3:The Neoclassical Model - Robert Solow

Capital accumulation and new technologies became the dominant force affecting economic development.

This approach was pioneered by Professor Robert Solow of MIT.

它假设经济中的生产函数可以通过劳动力和资本这两个生产要素的组合来描述,同时认为技术进步可以增加生产率。该模型主要关注资本的积累以及技术进步对经济增长的贡献,认为通过提高资本和技术的投入,可以实现长期的经济增长。该模型是现代经济增长理论的基础,也是许多经济学家在研究经济增长问题时的重要工具。

#4: New Growth Theory - Paul M. Romer

It seeks to uncover the processes by which private market forces, public-policy decisions, and alternative institutions lead to different patterns of technological change.

Unusual feature of technologies is that they are public goods, or non-rival(非竞争,理论上来讲)goods , they can be used by many people at the same time without being used up.

Seven Basic Trends of Economic Growth

- The capital stock has growth more rapidly than population and employment, resulting in capital deepening.

- Strong upward trend in real average hourly earnings for most of period since 1900

- The share of labor compensation in national income has been remarkably stable over the last 100 years

- more oscillations(波动) in real interest rates and the rate of profit

- The capital-output has actually declined since the start of the 20 century

- The national saving rate has declined sharply.

- National Product has grown at an average rate of close to 3 percent.

The sharp increase in energy prices in the 1970s following the OPEC oil embargo led firms to substitute labor and capital for energy in their production processes.

As a result, the productivity of labor and capital both declined relative to earlier growth rates.

Some economists believe that a deterioration(退化) in labor quality may be an important contributor to the productivity-growth slowdown.

Why Growth Rates Differ?

- Saving and Investment Spending

- Foreign Investment

- Education

- Infrastructure 基础设施

- Research and Development

- Political Stability, Property Rights, and Excessive Government Intervention

Chapter 9: The Challenge of Economic Development

注意:对于本章中经济收敛的概念,应理性辩证地看待,不应一概采信。

Are Economics Converging(收敛)?

Although real GDP per capita is still somewhat higher in the United States, the differences in the standards of living among the United States, Europe, and Japan are relatively small.

According to the convergence hypothesis(收敛假设), international differences in real GDP per capita tend to narrow over time.

Statistical studies find that when you adjust for differences in other factors, poorer countries do tend to have higher growth rates than richer countries. This result is known as conditional convergence(条件收敛). Is it possible?

LDC(Less developed country) or DVC(Developing country)

Regardless, developing countries is the country whose people have low per capita incomes.

Human Resources

#1: Quantity

Because of rapid population growth, many poor countries are forever running hard just to stay in place. Many developing countries are never able to escape the Malthusian trap(马尔萨斯陷阱) of high birth rates and stagnant incomes.

人口增长是按照几何级数增长的,而生存资源仅仅是按照算术级数增长的,多增加的人口总是要以某种方式被消灭掉,人口不能超出相应的农业发展水平。这个理论就被人称为“马尔萨斯陷阱”。

Some experts hold a view contrary to the traditional one that population growth can only be controlled directly.

This demographic transition(人口转型) view holds that rising income first must be achieved before slower population growth can be achieved.

#2: Quality

Skilled Labor is the crucial role of a economy.

Development programs to improve education, reduce illiteracy, and train workers as well as to improve public safety and health can make a developing country’s population much more productive.

This is because workers can learn to use capital more effectively, adopt new technologies, lose fewer days to sickness or injury, and better learn from their mistakes.

For advanced learning in science, engineering, medicine, and management, countries can benefit by sending their best minds abroad to bring back the newest advances.

Countries must be aware of the brain drain(智力流失), in which the most able people get drawn off to high-wage countries.

Natural Resources

Economists suspect that natural wealth from oil or minerals is not an unalloyed blessing**(无条件祝福)**. It is related to the political environment, culture background and so on.

Land ownership patterns are a key to providing farmers with strong incentives to invest in capital and technologies that will increase their land’s yield.

When farmers own their own land, they have better incentives(激励) to make improvements, such as in *irrigation systems(灌溉系统), and undertake appropriate conservation practices.

Capital Formation

Countries must abstain from current consumption to rapidly accumulate capital. However, When you are poor to begin with, reducing current consumption to provide for future consumption seems impossible.

Techonolgical Change

Since the reform and opening up, China has given full play to its advantages as a late mover and promoted its own economic growth and technological progress.

In history, economists and historists has discoverd some interesting factors some interesting factors that may affect the economic like weather, culture and so on.

Modern Views

Industrialization vs Agriculture - It is a question about a determination between short-run and long-run.

Market-dominated vs State(Government)-dominated

Import substitution vs Openness or outward orientation

The secret to success was not a doctrinaire laissez-faire policy, for the governments in fact engaged in selective planning and intervention.

Rather, the openness and outward orientation allowed the countries to reap economies of scale and the benefits of international specialization and thus to increase employment, use domestic resources effectively, enjoy rapid productivity growth, and provide enormous gains in living standards.

To make the transition from a centrally planned to a market-driven economy, all of communist countries must confront four basic reforms: price reform, currency reform, private property, and institutional reform.